Canada Vs Sweden For International Students 2024/2025

Canada Vs. Sweden For Foreign Students Studying overseas is one of the most beneficial … Read more

Can I Work In Germany With Poland or EU Work Permit? 2024/2025

Germany is a West European nation with over 83.24 million citizens. It has a … Read more

Job opportunities/ market In Norway For International Students 2024/2025

Norway has a thriving economy with an unemployment rate of 3.8%. The country prides … Read more

France Vs Canada For International Students 2024/2025

Canada remains one of the hubs for international students as it offers them quality … Read more

Germany vs. Australia for international students 2024/2025

Germany and Australia are two of the most popular destinations for international students. These … Read more

University of Florida nursing school acceptance rate 2024/2026

What is the University of Florida (UF) Nursing School’s acceptance rate for 2024-2026 ? … Read more

WELLS FARGO Scholarship Program For People With Disabilities 2024/2025

Being disabled has been a major concern for so many people as many capitalize … Read more

JAMB Registration 2024/2025 registration form fee, starting & closing date,

www.jamb.org.ng 2024/2025 registration form starting & closing date, exam DE|syllabus, profile, jamb news today … Read more

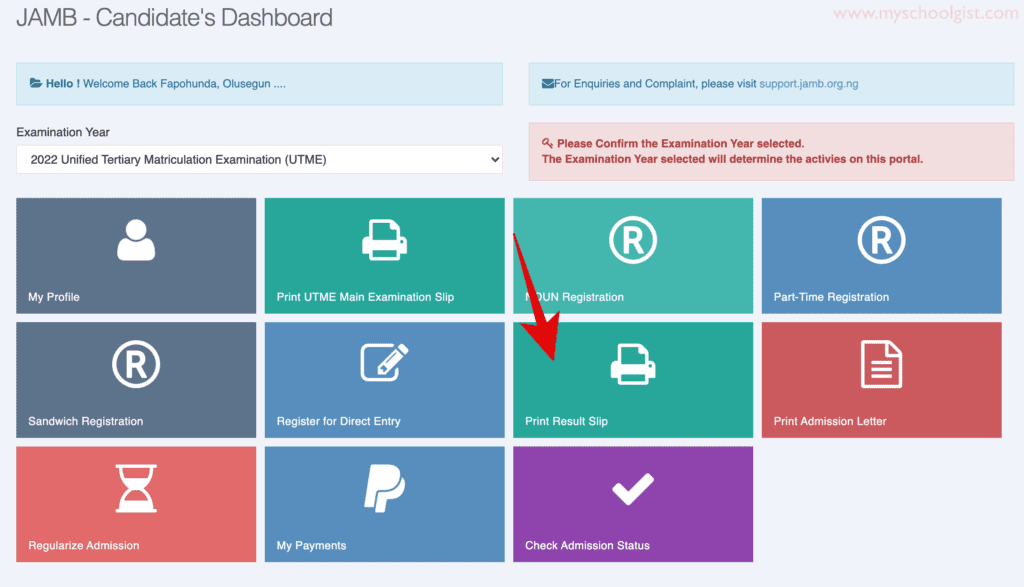

jamb 2024/2025 slipsprinting.jamb CheckUTMEResults

jamb 2024 result link slipsprinting.jamb.gov.ng/ CheckUTMEResults Is jamb result out? here are steps to … Read more

How to Reprint JAMB Slip 2024/2025 Date on jamb.org.ng For Exam Center & Date

JAMB reprinting 2024/2025 can be easily done without mistakes after you finish reading this … Read more

JAMB Profile Code Creation 2024/2025 Issues & Deadline

If you registered for the just concluded JAMB , you would notice slight changes … Read more

WAEC Timetable 2024/2025 Out: Download PDF Timetable MAY/JUNE

Waec Timetable Out: Check & Download PDF WAEC 2024/2025 Timetable MAY/JUNE WASSCE Is the … Read more

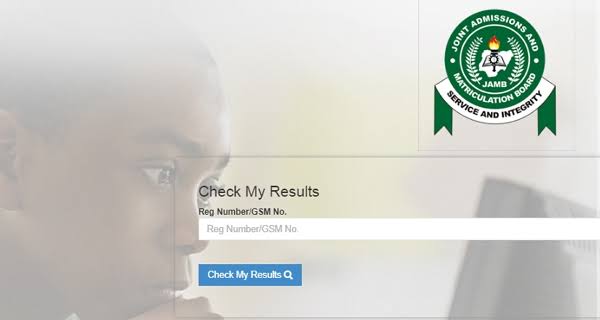

jamb result 2024/2025 Www.jamb.org.ng portal Login

jamb result Www.jamb.org.ng portal Login JAMB result officially out With a good number of … Read more

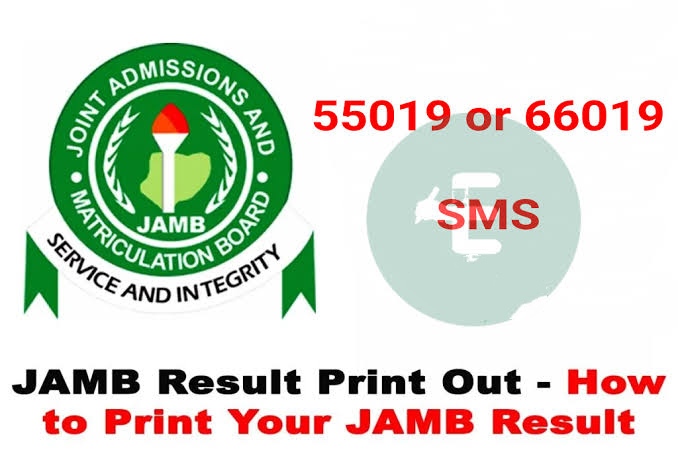

check JAMB 2024 result with SMS,phone, 55019 www.jamb.org.ng

How do I check my JAMB result with my phone? yes you can actually … Read more

JAMB Result Checker 2023/2024 Using Registration Number on Portal/Via SMS

Want to check jamb result 2023/2024 online? This is a simple but complete guide … Read more

Jamb 2024/2025 result for (25th,26th, 27th, 28th and 29th)

Jamb 2024/2025 result for (25th,26th, 27th, 28th and 29th) out/ Check JAMB result here … Read more

JAMB E-facility Portal www.jamb.org.ng login 2024/2025

Do you find it difficult to log into the JAMB E-facility portal? Are you … Read more

Receive the latest articles in your inbox

Insert your email signup form below

[insert e-mail subscription form]